Our investments

We invest in venture capital and private equity funds that develop Finland’s most promising growth companies. Tesi aims to create new high-quality international-scale funds in Finland to strengthen the availability of private equity and venture capital funding for companies.

We aim to grow new high-tech companies in Finland and enable them to scale up with domestic capital. We make market-driven investments in startup and scaleup companies with genuine potential for global scalable growth and a proven ability to expand.

- As a general guideline, half of our investments are direct investments and half are fund investments, but the allocation may vary depending on market conditions.

- To accelerate growth, Tesi, with its strengthened industrial policy role, can now participate in even larger growth funding rounds. Our investment activities increasingly emphasize the scalable growth of technology companies and the most promising industrial-scale projects. Tesi remains a market-driven minority investor.

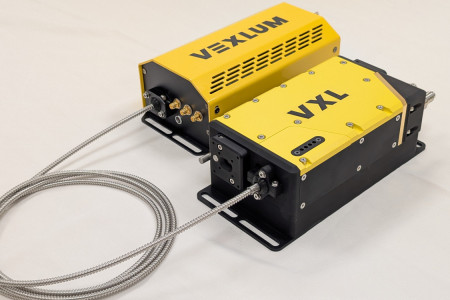

- Our focus areas include strategically important themes for Finland, such as deep technology, health and life sciences, clean economy, and defense technology. However, we may also invest in high-potential companies outside these themes, with no predefined sectoral or thematic restrictions.

- Tesi’s investment portfolio has significantly grown due to the following transactions: transfer of Finnvera’s venture capital operations in autumn 2021 and concentration of state capital investment activities under Tesi in early summer 2025.