Finnish venture capital (VC) funds are still burdened by the loss of confidence caused by the bursting of the tech bubble at the start of the millennium. Many investors burnt their fingers and consequently shifted their focus on other risk investments. This hampered the raising of venture capital funds. Now – some twenty years on – the situation has reversed. VC funds outperform other classes and have secured their position as sources of high returns.

More growth capital now available to Finnish startups

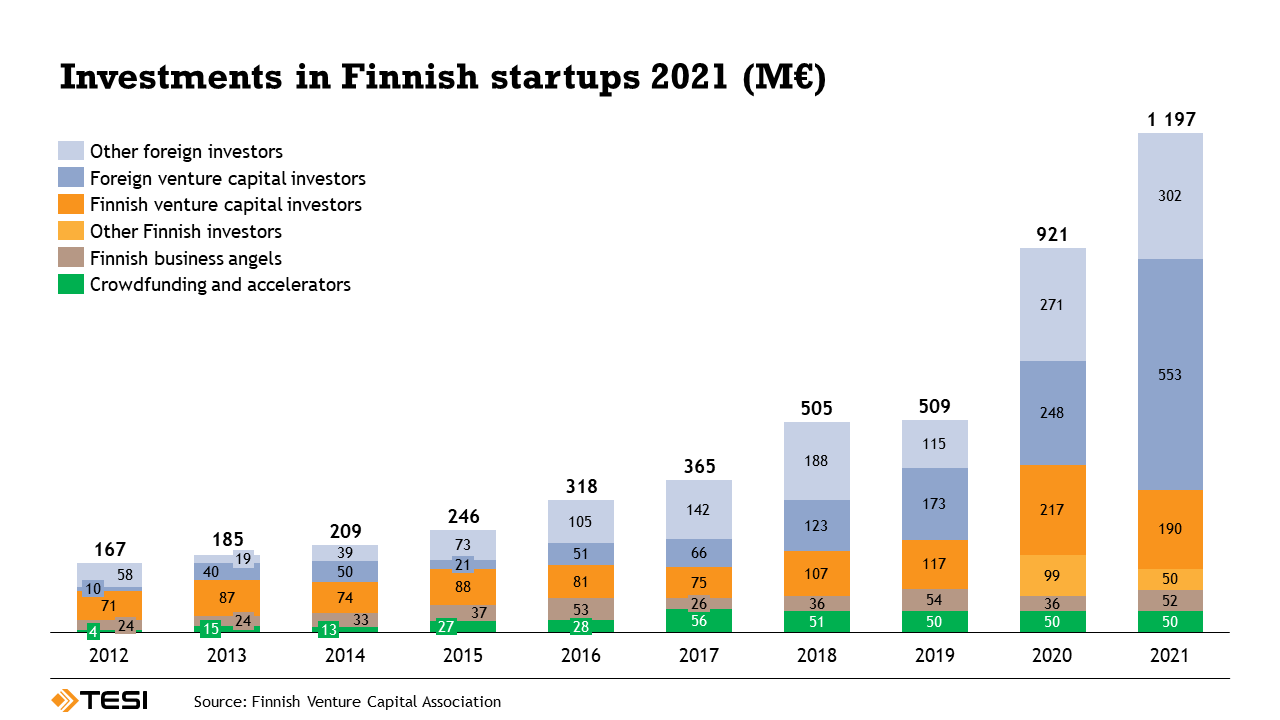

Ten years ago, there were only a handful of active Finnish VC funds, most of which were just starting their operations. The number of active funds has now doubled, with more entering the market. The capital raised by Finnish startups has, in fact, increased tenfold during the past ten years. Read more in FVCA’s (Finnish Venture Capital Association) ‘Venture Capital in Finland in 2021’ survey.

Increasingly many Finnish startups have succeeded in staying on a growth track for longer, and successful startups have had increasing success in attracting international investors. Although Finnish venture capital funds are growing in size, international funds are needed – in particular to finance companies in later-stage growth phases where capital requirements are larger.

Finnish Venture Capital Association’s ‘Venture Capital in Finland 2021’ survey shows a tenfold increase in financing for startups during the past ten years.

As a by-product of their success, Finnish venture capital funds have gained experience and improved their investment operations. In other words, they can offer startups more professional and more specialised expertise to support their growth. Such support can be valuable in, for instance, selecting strategies, finding talent, opening doors to international markets, and general sparring.

What is driving the growth in VC financing?

Given the low-interest environment since the financial crisis, investors have sought out riskier investments for some time now. For venture capital funds, this has provided opportunities for raising more funds and specialize in specific parts of Finland’s growing startup ecosystem.

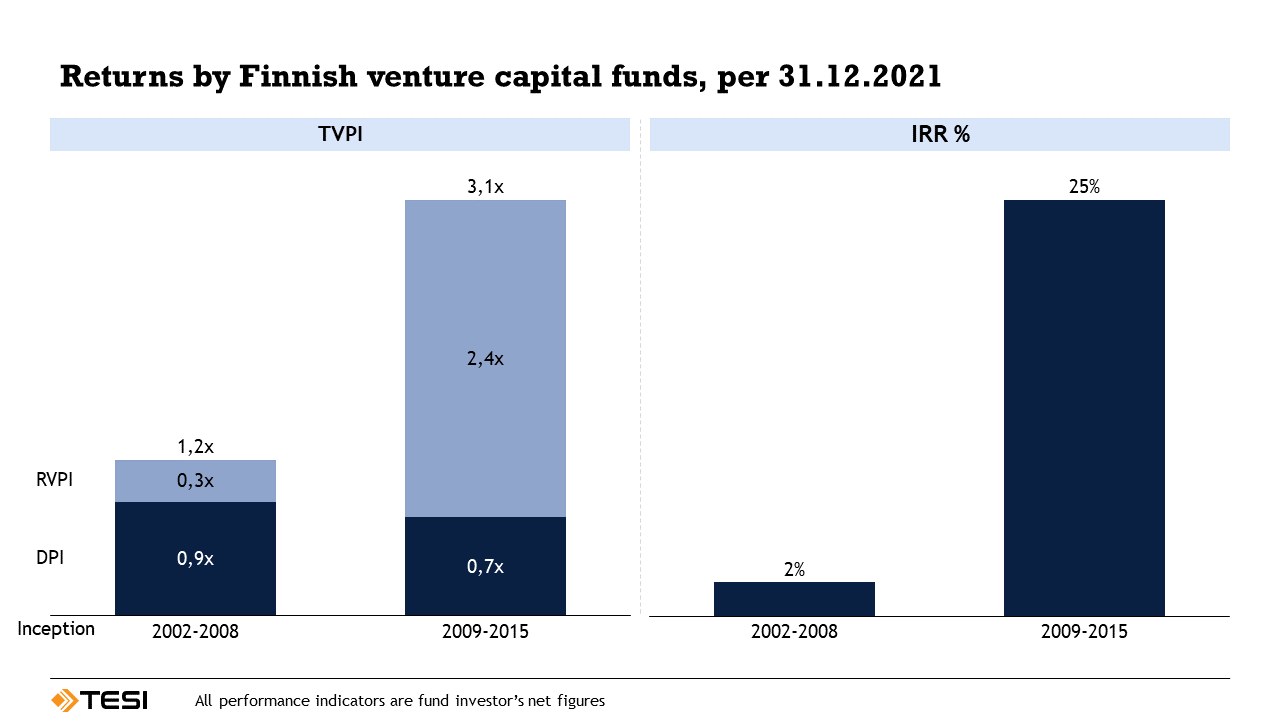

Finnish venture capital funds formed after the 2008 financial crisis have produced annual returns of some 25%, or 1.8 times the returns from the listed stock market. They have performed well in comparison to Finnish growth and buyout funds, which have generated annual returns of 17%, or 1.2 times the returns from the listed market. Venture capital funds’ growing return to risk ratio has started to interest a broader spectrum of investors. More detailed information about funds’ returns is available in Tesi’s Survey of Investment Returns 2022.

TVPI refers to Total Value to Paid-In = (Distributions + Net Asset Value) / Paid-In capital. DPI, on the other hand, refers to Distribution to Paid-In = Capital distributed to investors / Paid-In Capital

Although the number of Finnish funds has grown and expertise has increased, their size has remained smaller than the international average. Factors limiting the size of Finnish venture capital funds include institutional investors’ unwillingness to invest the small amounts that are required in Finnish funds, and a scarcity of resources in relation to the amount of capital under management.

Most larger Finnish institutions invest tens of millions of euros in investment commitments, mainly in larger international funds. Smaller institutions and wealthy individuals for whom Finnish funds are a suitable investment, on the other hand, are not sufficiently familiar with the operating principles of venture capital funds. A lack of resources also becomes emphasised in smaller institutions because a few people, at most, are responsible for all activities – including investment operations.

How can you get access to VC returns?

Venture capital funds invest in unlisted startup companies. Investors give a commitment to a fund at the start of its term, and the fund calls in capital from the investors as and when it makes investments. This procedure requires a fund investor to safeguard liquidity and be patient and willing to commit for a process that takes years. Consequently, to invest in venture capital funds and get returns investors need to be familiar with funds’ specific features and the way they operate.

It is not worthwhile trying to time fund investments to match market cycles. Venture capital is an investment class in which it is worth investing regularly each year. That way, the impact of cyclical fluctuations is dampened. Perhaps the best way to secure returns is, therefore, to invest with a long horizon and to diversify investments by investing in many funds operated by different managers. The amount an investor pays in management fees is earned back through diversification. Those investors who seized their opportunity ten years ago are now enjoying their returns.

Expertise and capital circulate in a properly functioning startup ecosystem

Finland’s startup environment has been technology-led in recent years. Nokia’s downhill slide opened the floodgates for innovation in Finnish startups. The same now-grown startups have produced new entrepreneurs and financers with experience and expertise. This is reflected in higher levels of business angel investments. In a properly functioning startup ecosystem, expertise and capital are not hoarded by one company – they circulate.

Recent successes have sprung up – perhaps surprisingly – in consumer products and services. Wolt, a platform company specialising in deliveries to end customers, raised over EUR 400 million in financing last year before being acquired by the US company DoorDash for seven billion euros. Swappie, a company refurbishing and selling used iPhones online, recently raised over EUR 100 million in financing. Both companies found their wings through Finnish VC funds.

VC-backed companies change the world and bring innovation within people’s reach. The success stories of the future are now being created especially in environmental technology and sustainable food production. Finnish venture capital funds have managed to grow companies on average faster than their European peers. The results of that are being enjoyed by entrepreneurs, employees and fund managers as well as investors. If you are or represent an aspiring fund investor, you can be a part of financing these success stories of the future, too.

Tesi (Finnish Industry Investment Ltd) is a state-owned investment company that wants to raise Finland to the front ranks of transformative economic growth by investing in funds and directly in companies. We invest profitably and responsibly, together with co-investors, to create the world’s new success stories. Our investments under management total 2.4 billion euros. www.tesi.fi | @TesiFII