We aim to grow new high-tech companies in Finland and enable them to scale up with domestic capital. We invest in companies with genuine potential for global scalable growth and a proven ability to expand.

To accelerate growth, Tesi, with its strengthened industrial policy role, can now participate in even larger growth funding rounds. Our investment activities increasingly emphasize the scalable growth of technology companies and the most promising industrial-scale projects. Tesi remains a market-driven minority investor, with no predefined sectoral or thematic restrictions.

Investment focus

Venture capital

- Venture capital investments are suitable for companies with strong potential for international growth. These include technology companies with scalable business models and high growth ambitions.

- We enhance venture capital market by participating as a minority investor in syndicates starting typically from Series A or B rounds, with sizes ranging from approximately EUR 5 million to tens of millions.

- Our individual investments usually range from EUR 2 to 10 million. Investments are always made in collaboration with private professional investors, primarily domestic and international venture capital funds.

- When making investments, we emphasize evidence of significant value appreciation potential, a strong team, and a competent syndicate.

- Our focus areas include strategically important themes for Finland, such as deep technology, health and life sciences, clean economy, and defense technology. However, we may also invest in high-potential companies outside these themes.

Our Venture & Growth Investments team

See our venture capital portfolio

Growth equity (scaleup and growth stages)

- We make minority investments in growth companies that are in the scaleup or growth phase.

- The capital needs of our target companies may include international expansion, product and service development, investments, balance sheet strengthening, and corporate transactions.

- When evaluating investments, we emphasize a credible scalable growth plan, a competent operational management team, proven evidence of growing business and profitability potential, and the expertise required to implement the value creation plan within the board and co-investors.

- Our target companies typically already have significant, often strongly growing revenue exceeding ten million euros. Investment rounds generally range from EUR 30–200+ million, with Tesin’s investments typically amounting to EUR 10–50 million.

- Executing a growth strategy usually requires long-term risk-taking and risk-sharing among multiple owners. Our co-investors include domestic and international growth-stage private equity firms, pension funds, industrial investors, and private investors.

- Our focus areas include strategically important themes for Finland, such as deep technology, health and life sciences, clean economy, and defense technology. However, we may also invest in high-potential companies outside these themes.

Our Venture & Growth Investments team

See our growth equity portfolio

Industrial investments

- Our investments focus on domestic industrial scaleup companies and large new industrial projects. Our role is to be a domestic anchor investor in the project development and construction phase.

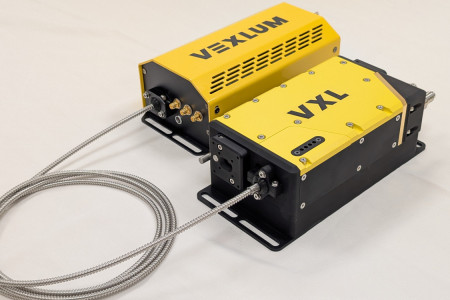

- Domestic industrial scaleup companies are typically Finnish industrial technology companies with proprietary new technology that require capital for development, piloting, production scaling, and commercialization. Tesi supports them from piloting to commercial scaling.

- Large new industrial projects involve proven technology, significant scale, and often include scaling through a project development company. The investments are significant, for example, in industrial sectors related to clean transition value chains (hydrogen, energy transition, metal refining). Tesi is involved in the initial project development and commercial scaling phases.

- The financing needs of domestic industrial scaleup companies typically range from EUR 50–200 million, while industrial-scale projects require anywhere from EUR 100 million to several billion euros. Our investment aims to leverage significant private capital. Every project Tesi invests in must have a strong industrial lead investor.

- Financing industrial projects usually requires long-term risk-taking and risk-sharing among multiple owners and financiers. Our co-investors include domestic and international private equity firms, pension funds, industrial investors, banks, private investors, and other public-sector entities such as Business Finland and Finnvera. In industrial-scale projects, we pay special attention to the successful implementation of the project financing model and a broad network of co-investors.

- We also invest in strategically significant defense industries for Finland, industrially important companies, and other special situations.

Tesi's key investment themes

sciences

Our focus areas include strategically important themes for Finland, such as deep technology, health and life sciences, clean economy, and defense technology. However, we may also invest in high-potential companies outside these themes.

EU’s market-based financing mechanisms

Tesi manages two market-based, co-financing programmes created with the European Investment Bank (EIB): the EFSI programme launched in 2018 and the EGF programme launched in 2022. Launched to mitigate the economic difficulties caused by the coronavirus pandemic, the EGF programme is part of the European Guarantee Fund.

Both programmes are EUR 100 million in size, with one-half of their financing coming from the EIB and one-half from Tesi. Investments are always made together, not separately. In both cases, the period for initial investments has ended. While investments in new companies are not made, follow-on investments are possible.