Tesi is an active co-investor

Tesi makes syndicated minority investments in Finnish companies together with a vast network of venture capital and private equity investors.

We invest together with private investors, on equal terms and with equal expectations for returns. As a principle, Tesi will not take a lead investor role. We are an evergreen investor with a typical investment horizon of 3–8 years. Based on the specific company needs, we appoint leading industry experts in the boards of our portfolio companies.

capital

We enhance the Finnish venture capital market by participating as a minority investor in syndicates starting typically from Series A or B rounds, with sizes ranging from approximately EUR 5 million to tens of millions. Our individual investments usually range from EUR 2 to 10 million. Investments are always made in collaboration with private professional investors, primarily domestic and international venture capital funds.

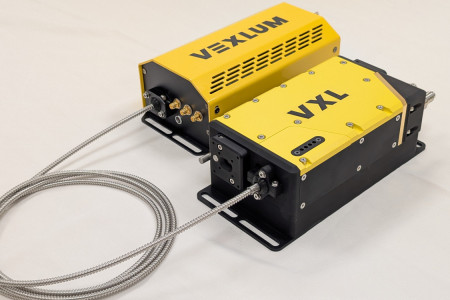

Our focus areas include strategically important themes for Finland, such as deep technology, health and life sciences, clean economy, and defense technology. However, we may also invest in high-potential companies outside these themes.

equity

We make minority investments in growth companies that are in the scaleup or growth phase.

Our target companies typically already have significant, often strongly growing revenue exceeding ten million euros. Investment rounds generally range from EUR 30–200+ million, with Tesin’s investments typically amounting to EUR 10–50 million.

Our focus areas include strategically important themes for Finland, such as deep technology, health and life sciences, clean economy, and defense technology. However, we may also invest in high-potential companies outside these themes.

investments

Our investments focus on domestic industrial scaleup companies and large new industrial projects. Our role is to be a domestic anchor investor in the project development and construction phase. The financing needs of domestic industrial scaleup companies typically range from EUR 50–200 million, while industrial-scale projects require anywhere from EUR 100 million to several billion euros. Our investment aims to leverage significant private capital. Every project Tesi invests in must have a strong industrial lead investor.

We also invest in strategically significant defense industries for Finland, industrially important companies, and other special situations.

Our profile as a co-investor

- We are a financially strong and stable investor with a long investment horizon.

- Our role in the syndicate is always adapted to the needs of the company. Typically, Tesi does not take a sole lead investor role.

- We are well-versed within the Finnish ecosystem and jurisdiction, and have a good visibility into local deal flow.

- We have strong networks in the international venture capital and private equity community.